How Do People With Crypto Currency Live If It Cant Be Converted Into Money

Although cryptocurrency can be used for illicit action, the overall affect of bitcoin and other cryptocurrencies on coin laundering and other crimes is sparse in comparison to cash transactions. As of 2019, only $829 1000000 in bitcoin has been spent on the nighttime web i (a mere 0.5% of all bitcoin transactions.) Since blockchain technology provides a public record of each transaction, exposure to the risk of financial law-breaking in cryptocurrency including bitcoin coin laundering is manageable. Yet, many MSBs remain unclear virtually their role in preventing money laundering and other offense on the blockchain, They may not know how to properly implement cardinal AML processes such every bit Know Your Customer (KYC) identity verification or they may just feel similar the challenges of unmasking criminals is a burden that's not theirs to bear. In these cases, MSBs May but look the other way rather than confront the trouble. This is a mistake - and it tin can be a costly 1. While criminals volition go along attempts to circumvent or exploit bitcoin's blockchain, money laundering can be headed off at the pass with tools that friction match client data with bitcoin transaction histories. This tin can brand information technology piece of cake for MSBs to identify high-risk customers, remain AML compliant, and avert the taint associated with crypto money laundering. Criminals employ crypto money laundering to hide the illicit origin of funds, using a diversity of methods. The well-nigh simplified form of bitcoin money laundering leans hard on the fact that transactions fabricated in cryptocurrencies are pseudonymous. The same concepts that use to money laundering using cash apply to money laundering using cryptocurrencies. There are three main stages of crypto money laundering: Cryptocurrencies tin can be purchased with cash (fiat) or other types of crypto (altcoin). Online cryptocurrency trading markets (exchanges) have varying levels of compliance with regulations regarding fiscal transactions. Legitimate exchanges follow regulatory requirements for identity verification and sourcing of funds and are AML compliant. Other exchanges are non as AML compliant, not that they aren't putting in the effort. It falls more to their ongoing struggle to exceed compliance regulations with sub-par tools. This vulnerability is where most transactions related to bitcoin money laundering take place. When exchanges are regulated, they are required to utilise KYC policies and protocols to their customers. This allows for the matching of transaction data to the respective customer, thereby breaking the 'anonymity' for each transaction. At Elliptic, nosotros don't shop client data; instead, we use client IDs (provided by exchanges) to match to transaction data. Crypto-based transactions can more often than not be followed via the blockchain. However, one time a dirty cryptocurrency is in play, criminals can use an anonymizing service to hide the funds' source, breaking the links betwixt bitcoin transactions. Often, the master excuse for illicit hiding activities is the argument that using anonymizing service providers protect personal privacy. This tin be accomplished both on regular crypto exchanges or by participating in an Initial Money Offering (ICO), where using one type of coin to pay for another type, can obfuscate the digital currency's origin. The point at which you can no longer easily trace dingy currency dorsum to criminal activity is the integration point - the final phase of currency laundering. Despite the currency no longer being directly tied to crime, money launderers still need a way to explain how they came into possession of the currency. Integration is that caption. A simple method of legitimizing the illicit income is to present information technology as the result of a profitable venture or other currency appreciation. This can exist very difficult to disprove in a market place when the value of any given altcoin can change by the second. Alternately, similar to how an offshore fiat currency depository financial institution account can be used to launder dirty coin, an online company that accepts bitcoin payments can be created to legitimize income and transform dirty cryptocurrency into clean, legal bitcoin. Some of the most prominent cryptocurrency money laundering cases involve one or more of the following practices: Mixing services, known as "tumblers," tin effectively split up up the muddied cryptocurrency. Tumblers send it through a series of various addresses, then recombine it. The reassembly results in a new, "clean" full (less any service fees, which tin can ofttimes be substantial.) In most laundering cases, the cryptocurrency starts in a legitimate wallet on the clearnet. It is transferred to a wallet in the dark web making multiple hops before landing in a second dark web wallet. It'south at this point that the currency is clean enough to bring back up to the clearnet and traded on a legitimate cryptocurrency exchange or sold for fiat. Some other avenue through which criminals can undertake bitcoin money laundering is unregulated cryptocurrency exchanges. Exchanges that are non compliant with AML practices and which fail to perform strict and thorough identity checks permit for cryptocurrencies to be traded over and once again across diverse markets, deposited onto unregulated exchanges, and traded for dissimilar altcoins. The repeated exchanges of one type of cryptocurrency for another can slowly clean the bitcoin, which criminals tin can somewhen withdraw to an external wallet. In rare cases, they might convert cryptocurrency into greenbacks, but this is atypical every bit fiat markets on unregulated exchanges are uncommon with but a brief tenure. To lower bitcoin cryptocurrency money laundering risk , many criminals turn to decentralized peer-to-peer networks which are frequently international. Here, they can frequently utilize unsuspecting 3rd parties to send funds on their way to the next destination. Nigh cryptocurrency money laundering schemes end with the clean bitcoin funneled into exchanges in countries with piffling or no AML regulations. Information technology's here that they can finally catechumen it into local fiat and utilise it to purchase luxury or other high-end items such as sports cars or upscale homes. There were five,457 bitcoin ATMs worldwide as of September 1, 20192. Continually continued to the cyberspace, bitcoin ATMs allow anyone with a credit or debit carte du jour to purchase bitcoin. Additionally, they may possess bi-directional functionality assuasive users to trade bitcoins for cash using a scannable wallet address. Bitcoin ATMs tin can also accept cash deposits, providing a QR code that tin can be scanned at a traditional commutation and used to withdraw bitcoin or other cryptocurrencies. Regulations used past financial institutions to obtain a record of customers and transactions for these machines vary by country and are ofttimes poorly enforced. Criminals can exploit loopholes and weaknesses in cryptocurrency ATM management to get around bitcoin money laundering risks. Prepaid debit cards loaded with cryptocurrency provide another artery for bitcoin money laundering. Prepaid cards can be used to fund different types of illegal activities, traded for other currencies, or handed off forth with associated PINs to third parties. Online gambling and gaming through sites that accept bitcoin or other cryptocurrencies is another way to conduct a crypto coin-laundering scheme. Crypto can be used to buy credit or virtual chips which users can greenbacks out again afterwards just a few small transactions. Elliptic AML allows users to configure hazard rules based on personal appetites for gamble. If you lot consider gaming high-run a risk, you lot can set your rules appropriately, and our tool will do the work for you. Elliptic AML monitors crypto transactions from addresses labeled as gaming sites, scores, & flags them alerting y'all with a rank based on your risk rule configuration. MSBs committed to controlling coin laundering will have to comply with legal frameworks in diverse countries implementing AML requirements. Compliance can help keep MSBs from becoming a front for cryptocurrency coin laundering cases reducing bitcoin money laundering risk. Compliance tin can farther cause criminals to shy abroad, keeping all transactions at the MSB free from the taint of dirty crypto. Insisting on AML process, procedure, and systems centralization and compliance, however, can come with a potential downside: the loss of business with a large contingent of crypto users eschewing such rules and regulations. The good news is centralization and compliance can easily start whatsoever negativity with the added legitimacy earned by accepting restrictions and implementing AML requirements - such as identity verification for each transaction. Additionally, better adventure management accompanies adherence to regulations that proactively assistance mitigate hazard exposure. Since hiding and obfuscating transactions are master methods of cryptocurrency laundering, insisting on a clear tape in the blockchain can further thwart money laundering attempts. When there is a clear unbroken trail of verifiable transactions, information technology becomes much harder to hide the origins of digital currencies. The United States has a muddled relationship with cryptocurrency. AML requirements for crypto to crypto transactions (as opposed to fiat to crypto or crypto to fiat transactions) have been inconsistent. In that location are also different thresholds for triggers regarding crypto as opposed to cash transactions. Globally, AML enforcement, when it comes to cryptocurrency transactions, varies widely – from relatively strict regulations in the UK, Netherlands, and much of Europe to practically non-real enforcement in other countries. In June, the Financial Action Task Force (FATF) issued a global requirement for cryptocurrency-related businesses to collect and share customer identities for each transaction, known as the Travel Rule. The Travel Rule requires crypto exchanges to laissez passer information about their customers to one another when transferring funds between firms. Member countries have ane yr to implement FATF guidelines (with a planned review set up for June of side by side year). The issuance was an attempt by FATF to cutting downwards on money laundering and funding of terrorist organizations. With a strong delivery to the precepts of anti-money-laundering, MSBs tin can add to their legitimacy while making cryptocurrency cleaning a hard, unattractive pastime for criminals. There are several ways an MSB tin can become and remain compliant with AML standards, including: An in-business firm team can help ensure compliance, but this tin can be expensive and impractical for smaller MSBs. In-house compliance teams will need the support of highly intelligent tools and platforms to assist spot potential money laundering in vast datasets or transaction histories. Different tools and services can help provide different means to verify the identity of people making cryptocurrency transactions. Automated monitoring of transactions can assistance identify suspicious patterns that may require a check to ensure AML compliance. With proper use of the immutable ledger for regulatory oversight known as the blockchain, money laundering using bitcoin or other cryptocurrencies becomes significantly more difficult. Utilizing blockchain technology for anti-money-laundering transaction monitoring requires matching blockchain transactions with the identities of those making the transactions. Doing then creates an stop-to-end trail that tin can go compliant with AML standards, permitting regulators to examine the records at any fourth dimension they need to trace specific transactions back to the individual. The cornerstone of anti-coin-laundering initiatives is identity verification. FATF's recommendations volition bring identity verification requirements for MSBs in line with those already used by financial institutions. Virtual Nugget Service Providers (VASPs) and MSBs will be required to Elliptic can assist MSBs by instantly and automatically tracing transactions through the blockchain, identifying illicit activities, and providing actionable intelligence to businesses and financial institutions helping ensure AML compliance and crypto-asset risk management. With Elliptic, organizations tin residual bodacious that they're meeting of import AML compliance requirements and keeping bitcoin (and other crypto assets) out of the hands of criminals. Learn more about how Elliptic can help bulldoze the legitimacy of bitcoin forward in a meaningful way through cryptocurrency forensics. The most consistent affair in the world of crypto compliance and regulation? Change. Domestically and internationally, the tides are constantly shifting and MSBs dealing in bitcoin and other crypto avails must be prepared to motion swiftly, adopt new standards, and protect their business organization from regulatory scrutiny. If you're looking for strategies and systems that will allow you to traverse this world of irresolute standards, picket our webinar on how crypto businesses can stay compliant and compete globally while mastering regulation and compliance. Scout: Managing Crypto Compliance Among Global Regulatory Alter Sources: ane. https://info.elliptic.co/whitepaper-fdd-bitcoin-laundering 2. https://www.statista.com/statistics/343127/number-bitcoin-atms/

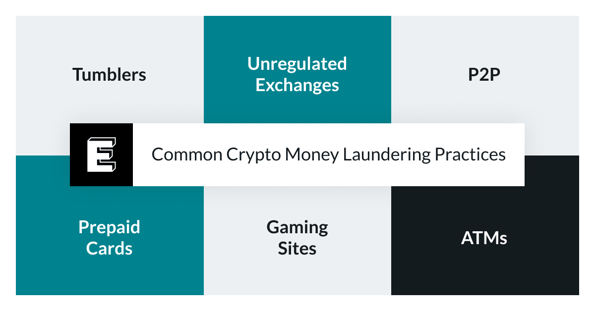

How criminals apply crypto to launder dirty money

Placement

Hiding

Integration

Tumblers

Unregulated exchanges

Peer-to-peer networks

Cryptocurrency ATMs

Prepaid cards

Gambling and gaming sites

Anti-coin-laundering solutions for MSBs

US and global approaches to crypto

How MSBs can assist ensure AML compliance

Hiring an in-house compliance team

Using bitcoin AML services and tools

Deploying upgraded blockchain technology

Establishing a trustworthy identification system

Integrating with the Elliptic automated platform

Regulation is irresolute

Source: https://www.elliptic.co/blog/bitcoin-money-laundering

Posted by: dinhuponce.blogspot.com

0 Response to "How Do People With Crypto Currency Live If It Cant Be Converted Into Money"

Post a Comment